I was recently speaking to a college-age family member, and I asked him if he was saving. He said, “Saving? Sure, I do it all the time.” I said, “Tell me more.” He said, “Andrew, I save, then six months from now, I spend it later.” I laughed and said, “That’s not saving. That is delayed spending.”

Saving is only storing your money. On the other hand, investing is all about multiplying your money and putting your money to work for you. So why is investing better than saving?

The Downside of Savings Products

Savings accounts, money market accounts, and CDs—or Certificates of Deposit—are not designed to beat inflation or provide a return that is exponentially powerful so you can retire on the funds.

In my office that provides financial advising, we call CDs “Certificates of Disappointment.” These accounts are great for your emergency fund that we encourage everyone to have—but if you want to invest your money so it can multiply, this is not the place.

Think about saving as only a parking spot for your money. If you don’t begin investing, you’re more likely to have someone convince you to take it from your parking space to their parking place because everyone is marketing to you.

Dangers of Inflation

Investing is so important because inflation is so serious. Inflation is where things get more expensive over time and the dollar loses value. A tide is rising while you’re standing still. Having savings in the bank allows you to float, but as the tide rises, you begin to drown.

Your money will depreciate with inflation if it’s not invested properly. A 1-2% return in your CD just isn’t going to keep up with inflation, especially at the rate that supplies and costs are increasing. People don’t think about this, but inflation risk needs to be considered when evaluating conservative investments, such as bonds, bond funds and money market funds as long-term investments.

While your investment may post gains over time, it may actually be losing value if it does not at least keep pace with the rate of inflation. Investing creates the opportunity for your money to grow faster than prices are increasing.

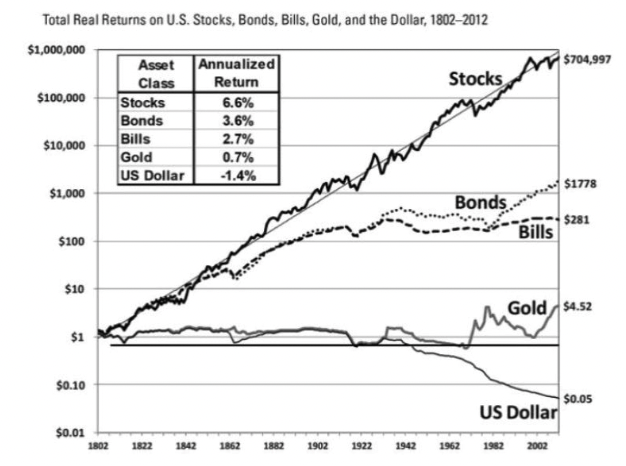

The chart below traces the growth of asset classes over time. Notice that the US dollar decreased in value while investments like gold, bonds, and stocks increased. The dollar losing value is inflation at work and why investing is so important.

Summary

One key financial habit we’ve covered today is don’t just save—invest! It’s not what you make, it’s what you keep that counts. It’s less about the number of dollars you’ve saved, and more about strategies you use with your savings.

So get your money off the sidelines, and start investing today. You may be asking, “Where do I start?” Great question. We’ve been releasing a series of blogs on investing basics, so check them out today!

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a meeting today or register to attend a seminar.