Abraham Lincoln wisely said, “Teach the children so it won’t be necessary to teach the adults.” God calls us to shepherd our children and grandchildren, which means to gently lead and guide them in God’s ways.

Where does this instruction begin? In the home! It’s not our pastor’s or children’s ministry’s or youth pastor’s job to train our children and grandchildren in God’s Word. They play a role, certainly, but discipleship begins in the home. Deuteronomy says talk of God’s commands when you walk by the way and when you rise up and when you lie down—which means as you go about your day (Deuteronomy 6.6-7). As you train the next generation in godliness, include what God says about money.

A shepherd’s crook or staff is a particular shape for a reason. Each part serves multiple purposes. The imagery of the staff is a great way to teach your kids what God says about financial stewardship and generosity.

Find a shepherd’s staff to show them, make one together, or have them draw or color an image of one and use it to illustrate what God says about money. Let’s see how.

Defense

The staff was used for defending the sheep against predators who came to attack them. The shepherd can see farther than his sheep, so he sees what’s coming down the path and any potential dangers that lay ahead.

In the same way, greed is a deadly snare. Trust me—it’s gotten my leg a time or two! I’m reminded of 1 Timothy 6.9: “But those who desire to be rich fall into temptation, into a snare, into many senseless and harmful desires that plunge people into ruin and destruction.”

When your children are tempted by the snare of greed, use your wisdom like the bottom of the staff. Let your pointed wisdom drive your children away from comparing themselves to others, desiring the gifts instead of the Giver, and being satisfied with the things of this world instead of Christ.

Balance

When you hike rough terrain, a staff helps you stay balanced and keeps you firmly planted on the ground. How do you keep your children and grandchildren financially balanced?

You may have a child who excels in saving—which can turn into a life-long habit of investing for the future! But children for whom discipline comes easy may be more tempted to hoard money or possessions instead of being generous. This can keep them from relying on God for provision.

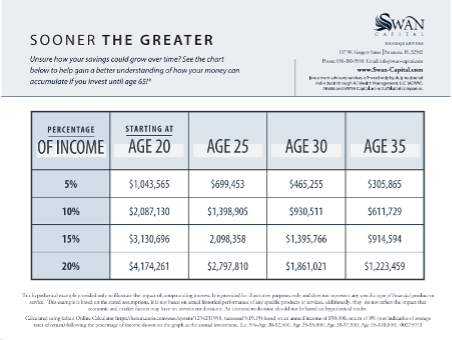

Then you have the other extreme: Children who only want to live in the moment without any consequence to tomorrow! It’s your job to educate them about how time is their greatest asset, but it’s passing by. They need to see the numbers like this chart:

That’s the power of compound interest! Someone who starts saving five percent of their income at age twenty is going to have almost the same amount saved at retirement as someone who started saving twenty percent of their income at age thirty-five! The more you delay saving a portion of your income into long-term investment accounts, the more money it will cost you in the long run.

So how can you teach your children and grandchildren savings from a young age? That brings us to our next point.

Separate

The shepherd’s crook is also useful when trying to separate. It can part thick undergrowth of trees and briars and tall grasses when searching for lost sheep or potential predators. Use your wisdom to help children start early the habit of separating their money into three distinct buckets. This is a life-long lesson they can start applying now!

- 10%—Giving. The first bucket is for giving. That means the top 10% of whatever they earn goes to Lord right off the top. It’s their tithe. They are to dedicate their first fruits to God just as they dedicate themselves to him.

- 20%—Saving. The next 20% goes into long-term investing. Why? Because they never want to rely on anyone for financial assistance if they don’t have to.

- 70%—Spending. The last 70% is for them to spend and enjoy for their hard work.

Many clients I speak to learned this lesson when it was too late. I encourage you to take this practical example of the three buckets and start guiding your children now!

Hook

The hook of the staff comes in handy when catching sheep. You loop the hook around the animal by the hind leg or the neck. Catching them like this may seem harsh at first, but the shepherd knows what’s best. Maybe he needs to capture the sheep to treat a wound or prevent the animal from falling into danger.

In the same way, you know what’s best for your children and grandchildren. But it has to be their idea. They need to come to the same revelation you’ve already had. You can’t tell them because they probably won’t listen; you must show them what happens to those who have little margin in their life. Serve together at a homeless shelter and soup kitchen. Take them on long-term and short-term mission trips to show them what real poverty looks like. Let their minds form their own conclusions.

This hook also helps recover fallen or wayward animals by ensnaring them so we can bring them back to safety. Practically, this means we pick up teenagers or young adults who blow it financially. Now we first have to let the sheep fall into trouble to learn. This is the hardest part as a parent to see our children struggle. But if you never let your children struggle, they’d still be crawling around instead of walking.

This means when the teenager has a fender bender or the college student blows their first paycheck and has to eat ramen noodles for two weeks in a row, let them experience the consequences of their actions. Then it’s time to pull the hook around them—to put your arm around them and teach them how to avoid this situation in the future.

Summary

Today we used the shepherd’s staff as a metaphor for how to guide your children financially.

You’re probably familiar with Psalm 23 when it says, “Your rod and your staff, they comfort me.” The sheep see the staff and know they are in the shepherd’s tender, loving care. In the same way, your children and grandchildren need your financial wisdom and guidance more than they know. Shepherd them into paths of righteousness as they grow. They’ll grow up to thank you for it.

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a meeting today or register to attend a seminar.